Japan’s National Consumer Affairs Center on Wednesday suggested citizens start “digital end of life planning” and offered tips on how to do it. The Center’s somewhat maudlin advice is motivated by recent incidents in which citizens struggled to cancel subscriptions their loved ones signed up for before their demise, because they didn’t know their usernames or passwords. The resulting “digital legacy” can be unpleasant to resolve, the agency warns, so suggested four steps to simplify ensure our digital legacies aren’t complicated:

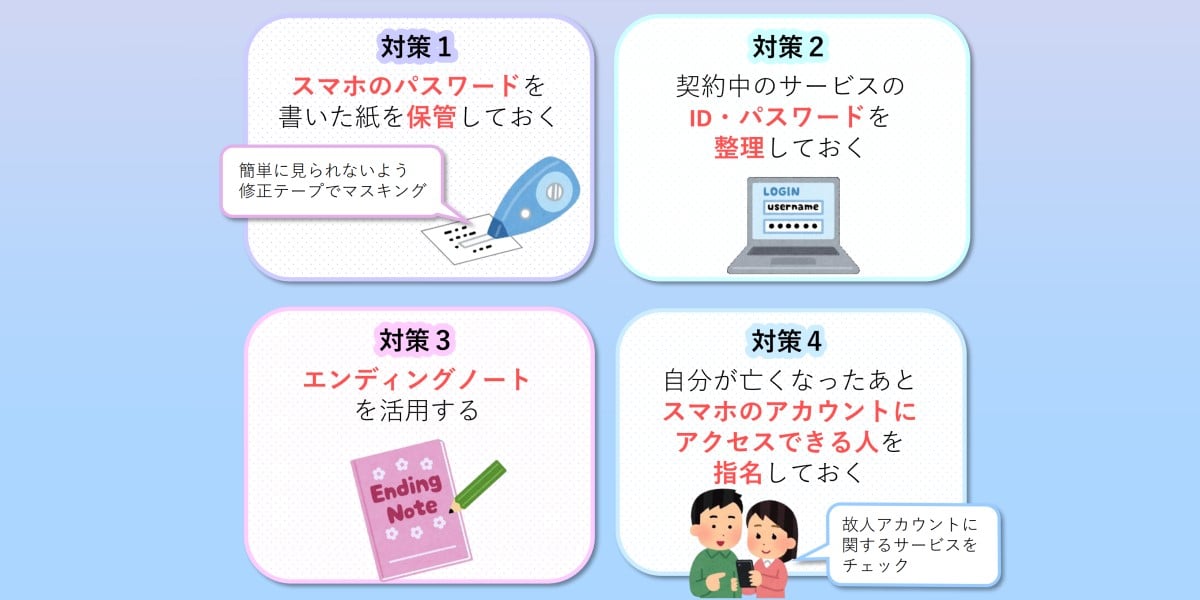

- Ensuring family members can unlock your smartphone or computer in case of emergency;

- Maintain a list of your subscriptions, user IDs and passwords;

- Consider putting those details in a document intended to be made available when your life ends;

- Use a service that allows you to designate someone to have access to your smartphone and other accounts once your time on Earth ends.

The Center suggests now is the time for it to make this suggestion because it is aware of struggles to discover and resolve ongoing expenses after death. With smartphones ubiquitous, the org fears more people will find themselves unable to resolve their loved ones’ digital affairs – and powerless to stop their credit cards being charged for services the departed cannot consume.

Eh The things that actually matter, like phone, banks and utilities, and just about everything else, only require you tell them of the death. They might want proof such as a death certificate, but that’s normal.

The article mentions things like auto-payment subscription services which can definitely be a pain to deal with (even while you’re alive lol). Depending on how the payments are setup, it can be as easy as having the bank cancel the debit/credit card. For direct debit from checking accounts, though, it’s often a lot more complex to get stop payments on those (been there, unfortunately).

So leaving your account details (in a password manager, text file, notebook, etc) has some tangible benefits. At the very least, it makes it easier on your survivors to handle your affairs.

Strangely, I used to work for a bank in their “bereavement services” department; that is, the department that dealt with dead people’s accounts.

If anyone notified us of a death of an account holder, and provided any proof (death certificate, coroner’s report, police letter), the first thing we’d do is freeze the account. All payments out stopped, all cards cancelled, all withdrawals blocked. This was a legal requirement, because once somebody dies their money becomes the legal property of their “estate”, and it’s unlawful for anyone to remove money from the estate without following proper process.

There’s no need to stop each payment individually. In fact, the bank really doesn’t want you logging in to their online bank using the deceased’s credentials and messing around with things for the same reason; unless you’re following proper procedures, it’s not yours to mess with.

Possibly it’s different in different jurisdictions, of course.

Oh don’t get me wrong, i think it’s a good idea. Just be mindful that financial companies (for example) don’t think you’re in the account fraudulently. Tell them the person is deceased and then provide the account info you have.

Well, yeah, for banks and “official” services like that. Otherwise, it’s fraud and you’ve got a whole new set of issues to deal with.

deleted by creator

I could be wrong, but i think debt transfers to a relative.

Depends on the state and the type of debt. Have a mortgage? The bank will give the next of kin the opportunity to take over the payments. If they dont’t pay the mortgage, the bank will foreclose on the loan. But if Netflix comes after your kid for not paying your subscriotion fee after you die? They can fuck right off. At least, where I live.

Or they could be like Disney and deny something important because your cousins uncles grandfather had Disney+ for a week!

But I’m with you. Stop all payments.

Crap, i delete my first comment. Luckily i copied it right before, lol.